401k early withdrawal calculator fidelity

Starting at age 59½ you can take withdrawals without penalties though note that taxes may be due based on the type of IRA. 401k Early Withdrawal Calculator.

Listing Of All Tools Calculators Fidelity

Use this calculator to estimate how much in taxes you could owe if.

. Early Withdrawal Calculator Terms Definitions. You are not required to take. If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under.

In many cases youll have to pay federal and. To request a withdrawal greater than 100000 you must. A Retirement Calculator To Help You Discover What They Are.

In some cases its possible to withdraw from retirement accounts like 401 ks and individual retirement accounts before your retirement age without a penalty. The Planning Guidance Center helps make it easy to get a holistic view of your financial plan from one place. Using this 401k early withdrawal calculator is easy.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. If you are between 59½ and 72. How To Start My Own 401k.

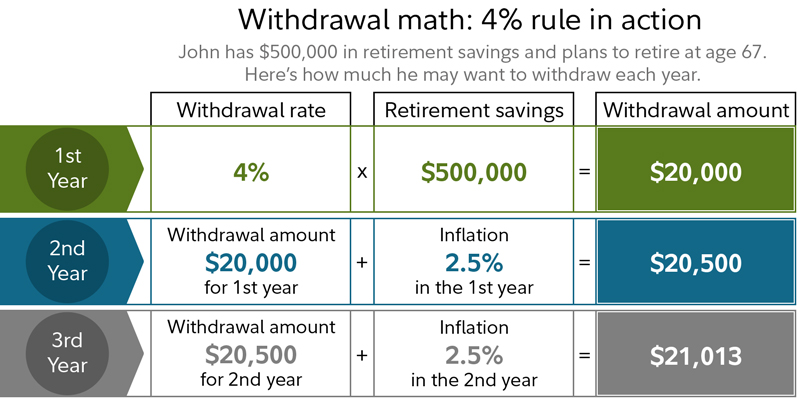

Explore your retirement income stream by using our retirement income calculator. Ad A Retirement Calculator To Help You Plan For The Future. An early withdrawal is generally a distribution you take before you reach age 59 ½.

Retirement Calculators Tools Fidelity Learning Center Content for this page unless otherwise indicated with a Fidelity pyramid logo is selected and published by Fidelity Interactive Content. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with projections early withdrawals or maximizing employer match. Ad 0 Online US Stock Trades.

Use a 401k Early Withdrawal Calculator. The maximum you can request to withdraw from your account online or by telephone is 100000 per account. If you are considering a withdrawal from one of these types of IRAs before age 59½ it will be considered an early distribution by the IRS.

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. If the above 3 steps are not an option for you and you want to get a better understanding of how much money youll owe by.

Ad Download Our Program Highlights and Show Clients the Benefits of a SIMPLE IRA Plan. No Minimums for Retail Brokerage Accounts. The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½.

Ad 0 Online US Stock Trades. 401k â A tax-qualified defined-contribution pension account as defined in. Offer Your Clients Lower Costs and Less Complexity with SIMPLE IRAs.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. With this tool you can see how prepared you may be for retirement review and. If you withdraw money from your.

Learn how you can impact how much money you could have each month. No Minimums for Retail Brokerage Accounts. Individuals will have to pay income.

The maximum you can request to withdraw from your account online or by telephone is 100000 per account. Discover The Answers You Need Here. You may be subject to a 10 tax penalty for early withdrawal in addition to any federal and state income.

How Much Should I Have Saved In My 401k By Age

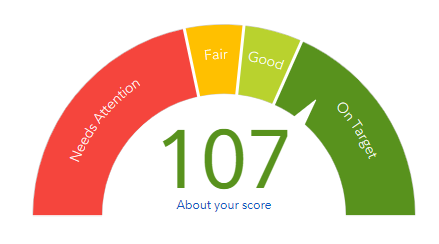

Fidelity Retirement Calculator Review

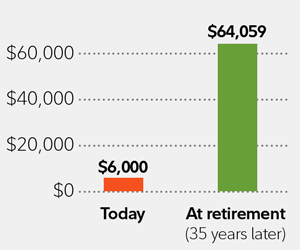

Beware Of Cashing Out A 401 K Pension Parameters

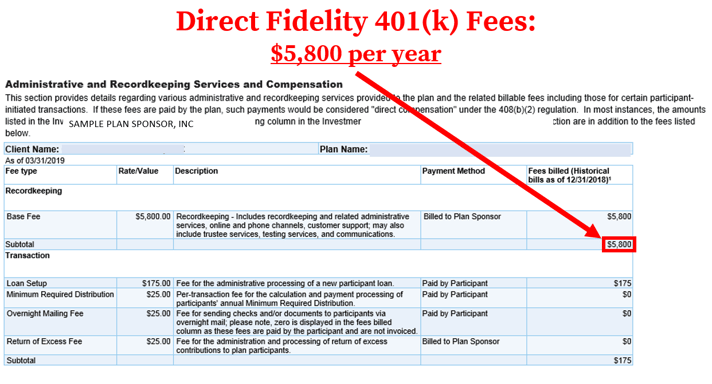

How To Find Calculate Fidelity 401 K Fees

Fidelity Retirement Calculator Review

How Much Fidelity Bond Coverage Are We Required To Have

Roth 401k Roth Vs Traditional 401k Fidelity

Retirement Accounts A Comprehensive Guide Meld Financial

401k Retirement Withdrawal Calculator On Sale 57 Off Myelectricalceu Com

Contributing To Your Ira Start Early Know Your Limits Fidelity

Listing Of All Tools Calculators Fidelity

Fidelity Go Review Smartasset Com

How To Rollover A 401k Into An Ira Nextadvisor With Time

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Beware Of Cashing Out A 401 K Pension Parameters

Roth Conversion Q A Fidelity

Fidelity Annuity Immediate Annuity